Coastal Community Foundation’s investment philosophy has two key objectives:

1- to provide sufficient income for current charitable support

2- to preserve the purchasing power of the Foundation’s assets through capital appreciation

The Foundation’s prudent investment policy allows the Board to meet the goal of providing for current charitable needs while maintaining and enhancing long-term purchasing power.

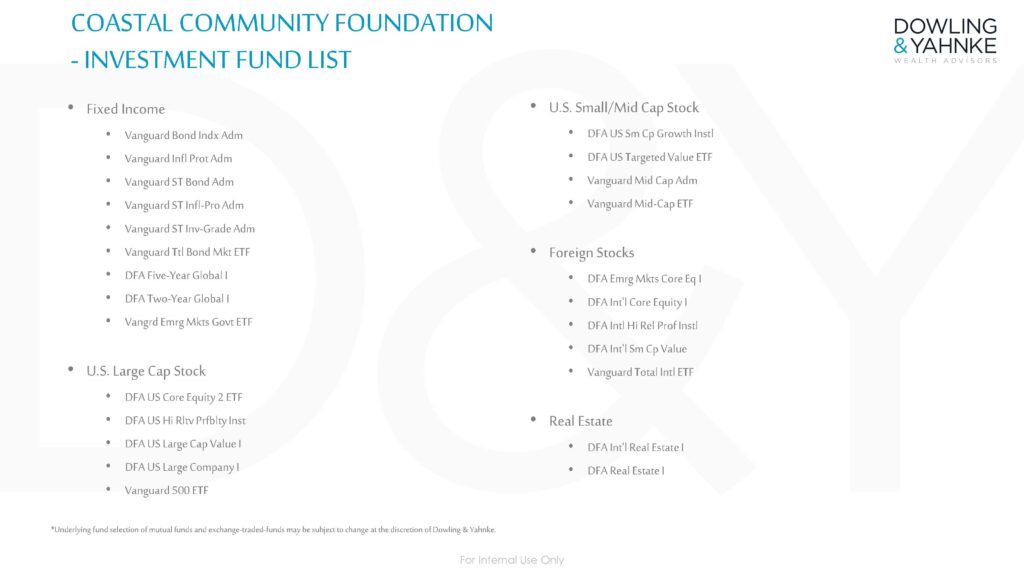

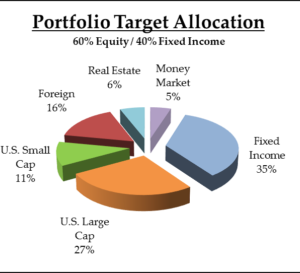

The Foundation’s assets have been professionally managed by Dowling & Yahnke a local firm that has been in business since 1991. The emphasis in on low-cost, passive, long-term investment. The investment allocation currently is:

5 % Cash and cash equivalents

35% Fixed Income (High short to intermediate-term bonds)

60% Stocks (Exposure to Large US, Small US and Foreign Stocks, Real Estate Securities)

Investment Return 2022 -12.2%

Investment History

|

2011 |

.05% |

|

2012 |

11.7% |

|

2013 |

15% |

|

2014 |

4.8% |

|

2015 |

1.6% |

|

2016 |

8.54% |

|

2017 |

12.5% |

|

2018 |

-5.87% |

|

2019 |

17.02% |

|

2020 |

10.24% |

|

2021 |

13.67% |